An emphasis on advanced analytic technology

While we use fundamental analysis to zero in on the most interesting stocks to watch, our true competitive edge stems primarily from the advanced proprietary Exponential Pattern Recognition (XPR) technology we have built.

Throughout stock market history, the behavior of investors—particularly institutional investors—that precedes the breakout and exponential growth of market-leading stocks has essentially followed the same patterns over and over again. With XPR, we seek to match any current pattern of market behavior with similar patterns from the past—and the outcomes they led to.

This gives us a powerful tool for anticipating the major uptrends of leading stocks, as well as their downtrends.

XPR Technical Analysis is designed to detect definitive buy and sell signals that visual inspection of technical charts—even by experts—often doesn’t reveal. We use it to pinpoint when to buy and when to sell the stocks we are following—which has had a huge effect on investment results.

We have developed three tools that work together on our XPR platform:

Used for identifying beneficial buy and sell points of specific stocks

Used for identifying likely tops and bottoms of the stock market as a whole

Tracks the activity of the nation’s smartest professional investment managers

Our strategy is NOT buy-and-hold; we want to identify market tops so that we don’t get caught by surprise in a market downturn. But market tops are particularly difficult to discern due to often conflicting signals and the fact that market cycles tend not to repeat in exactly the same ways. We use a combination of our XPR Market Analysis and our Leading Stock Index (LSI) to help us identify market tops.

When we detect adverse market conditions, we generally reduce the Fund’s overall market exposure so as not to be penalized by the sometimes irrational sentiments of the investing public. At the same time, we typically continue to steadfastly hold a strategically determined allocation of our leading stocks so we can capture the rapid upturn that invariably follows a down market.

When the market lacked opportunities during the Covid pandemic, we moved to cash to preserve capital. We then re-entered the market vigorously when it made sense and were able to recover completely, surpass our previous high point and maintain our commitment to delivering long-term exponential growth.

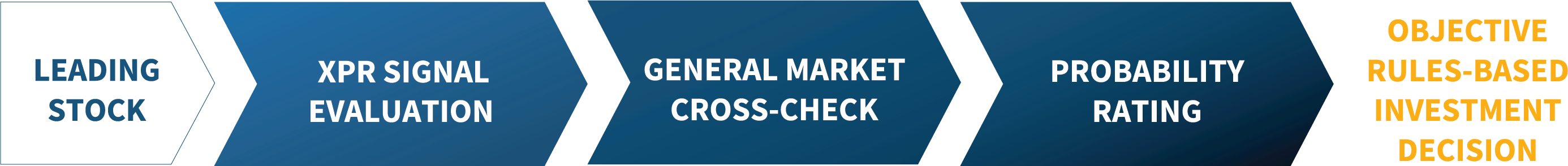

Investment managers are only human and susceptible to basing investment decisions on emotional reactions rather than objective criteria. That is why our decision-making process is data-driven. We use our multi-step process to arrive at objective, probability-based investment criteria.

At FIZYX, we strive to balance our formidable offense with strict defensive risk-management disciplines to protect against three critical categories of risk: Systemic risk in the stock market, risk to the portfolio-as-a-whole, and the risk inherent in each individual stock position.

Email: in**@***yx.com